31

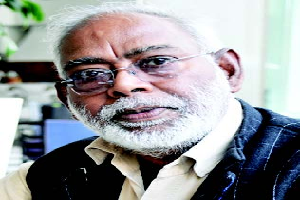

Prof. Lallan Prasad

New Delhi | Wednesday | 31 July 2024

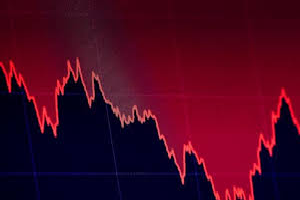

The Union budget presented by the Finance Minister on July 23, 2024, has a long-term growth perspective -making India the third largest economy in the world. Still, the needs of the poor, farmers, unorganized workers, SMEs, youth and housewives are not adequately addressed. Some of the key features of ₹48 lakh crore budget for 144 crore people are fiscal consolidation, capex, skill development, natural farming and crop productivity, green investment and research, housing for all, and simplification of the tax regime.

The fiscal deficit target has been lowered to 4.9% from 5.6% of GDP last year. From 2026-27 onwards the government intends to keep the deficit each year such that the central government's debt will be on a declining path as a percentage of GDP. The government's gross borrowing during 2024-25 expected to be Rs.14.01 lakh crore is on a higher side and needs to be curtailed. Government expenditure on subsidies is expected to be Rs. 381175 crore as against last year's Rs.413958 crore, expenditure on both food and fertilizers subsidies which constitute the biggest component of subsidy has been brought down. The capital expenditure to boost the economy and plug the supply gaps in infrastructure has been kept at 11.1 crore which is 3.4% of GDP. The effective capital spending figure however, for 2024-25 including interest-free loans to states is expected to be rupees 15 lakh crore.

The Indian government's 2024 budget, presented by the Finance Minister on July 23, 2024, has a long-term growth perspective, aiming to make India the third-largest economy in the world. While it outlines several initiatives to boost economic growth, it falls short in addressing the needs of the poor, farmers, unorganized workers, SMEs, youth, and housewives. Key Highlights: Fiscal deficit target lowered to 4.9% of GDP Increased capital expenditure to boost infrastructure development Incentives for firms in manufacturing, cheaper loans for higher education, and internship programs for youth Plans to train 2 million youngsters and provide jobs to 41 million in 5 years Allocation of Rs. 3 lakh crores for schemes benefiting women and girls Increased spending on health and education, but still lower than recommended Agriculture and MSMEs: Comprehensive review of agriculture research to raise productivity Introduction of 109 high-yielding and climate-resilient crop varieties Allocation of Rs. 1.52 lakh crore for agriculture and allied sectors, deemed inadequate MSMEs to benefit from increased collateral-free credit guarantee scheme and new credit assessment model Energy and Space Economy: Diversified energy plan focused on small nuclear reactors, rooftop solar plants, and indigenous technology Venture capital fund of Rs. 10,000 crores to expand space economy Tax Regime: Simplification of tax regime and promotion of new tax regime Reduced tax rates and increased standard deduction Increased capital gains tax and removal of indexation benefit Overall, the budget has a mixed bag of initiatives, with some positive measures to boost economic growth and social welfare, but also some shortcomings in addressing the needs of key sectors and demographics.

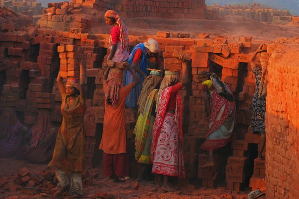

Employment boosting measures announced by the Finance Minister include incentives for firms in manufacturing, cheaper loans for higher education, internship programs in companies for youth with stipends and credit flow to small businesses. The government plans to train 2 million youngsters, upgrade 1000 training institutes and provide internships in 500 top firms for 10 million with a stipend of rupees 5000 per month for one year. In 5 years Government is targeting to provide jobs to 41 million youngsters. The government realizes that enough good quality jobs for its rising workforce have not been created. The unemployment rate was 9.2% in June 2024. The budget provides rupees 3 lakh crores for the schemes benefiting women and girls which include setting up working women's hostels on a model and creating opportunities for higher participation of women in work force. Housewives' main major problem is the rising cost of food grains, vegetables, milk and other day-to-day requirements of the kitchen which have not been effectively addressed in the budget. The urban and rural housing schemes are allocated Rs.822576 road and Rs.54000 crore for 2024-25. Spending on health and education both in absolute terms of proportion in the budget compared to revised estimates of 2023-24 has been increased, however, this is much lower than what the 2017 National health policy States that the centre and States should spend 2.5% of the GDP on health and 6% on education.

Agriculture has been identified as one of the 9 top priorities of the government. It is proposed to have a comprehensive review of agriculture research set up to raise productivity and development of the Indian varieties. The Government will introduce 109 high-yielding and climate-resilient varieties of 32 field and horticultural crops. Rs.60000 crore has been allocated in the budget for PM Kisan a cash transfer scheme. The Government also plans to set up clusters of vegetable farms around large cities to boost supply and enhance market excess. The budget also proposes to link digitized land records with farmers' databases and agri-stock. Government proposes to promote more chemical-free agriculture. Allocation for natural farming in the budget is Rs.365 crores. Allocation for agriculture and allied sectors in the budget stands at rupees 1.52 lakh crore which is inadequate given the contribution of this sector which is the backbone of the Indian economy. Jan Samarth Kisan's credit card will be issued in 5 states. Funds will be provided for financing of shrimp farming and export of agricultural products. However, the farmers are disappointed because the government has ignored their long-standing demand for a guaranteed price for their products without which doubling their income will remain a dream.

The government is planning a diversified energy plan focused on small nuclear reactors, rooftop solar plants and the development of indigenous technology for advanced ultra-supercritical thermal power plants. A venture capital fund of Rs.10000 crores will be set up for expanding the space economy by five times in the next 10 years.

MSMEs are the largest employer after agriculture. The budget proposes to raise collateral-free credit guarantee scheme to help purchase machinery and equipment from Rs.10 lakh to Rs.20 lakh. A new credit assessment model is envisaged to enable PSU banks to build their in-house capability to access the credit demand of this sector. Simplification of GST procedure and rationalization of rates are needed which has not been considered by the Government. Ending of Angel tax and reduction of long-term capital gain tax for unlisted security will benefit venture capital and private equity investors.

Bihar and Andhra are given special packages for development. Bihar has secured Rs.26000 crore for road connectivity projects, new airport and sports infrastructure and Rs.11500 crore for flood mitigation which has been a major demand of the state. Andhra Got rupees 15000 crore to develop the capital at Amravati. Funds will also be released for the state for early completion of the Polavaram irrigation project on the Godavari River and essential infrastructure in two major industrial corridors. Odisha also needs such a package but has been ignored.

One of the priorities of the budget is a simplification of the tax regime and promotion of new in place of the old one which provides incentives for savings. Tax rates are slightly reduced in the new income tax regime in which no deductions are allowed for investment. Standard deduction has been raised from rupees 50000 to 75000. These measures will result in some reduction in tax payable by the individuals as well as the corporates. However, the capital gains tax has been increased from 10 to 12.5% and the benefit of indexation has been taken away. The government wants people to spend more and save less to increase market demand for goods and services, but this may affect saving habits. Exemptions in customs duties are granted on 25 critical minerals which will benefit sectors like space, defence telecommunication, Hi-Tech electronics, nuclear energy and renewable energy. Reductions in custom duty on gold and silver jewellery and textile and leather inputs for manufacturing are welcome.

---------------