9

Prof Shivaji Sarkar

New Delhi | Wednesday | 9 October 2024

The Indian stock market appears to be on the brink of a downturn, with signs of instability and uncertainty looming large. Recent data indicates that India’s Buffett indicator— a measure comparing the stock market value to the country's GDP—has surged past its historical average of 0.83, reaching over 1.4. This significant rise suggests that the market is overvalued. Concerns about a potential bubble have been circulating, as many analysts previously cautioned about the unrealistic climb of the Sensex above 85,000 points. The impact of this market correction has been severe, with losses in a single week estimated at over ₹13 lakh crore.

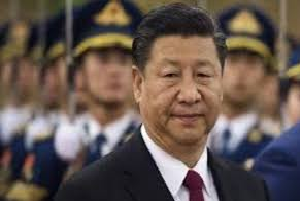

Some of the largest losses have been borne by key players in the market. Reliance Industries dropped by 87.37 points, HDFC Bank by 76.36 points, L&T by 38.8 points, Axis Bank by 30.88 points, and ICICI Bank by 25.97 points. Together, these five companies contributed to a 547-point drop in the Sensex. Between October 1 and 4 alone, the Sensex plummeted by over 3,300 points, as Foreign Institutional Investors (FIIs) withdrew approximately ₹32,000 crore from Dalal Street. The increasing appeal of China’s market, coupled with global concerns over the Iran-Israel conflict, has caused investors to pull back from Indian equities. The possibility of a market crash during the festive season has further fueled uncertainty, despite continued confidence among retail investors.

Article at a Glance

The Indian stock market is experiencing a period of instability and uncertainty, with signs pointing to a potential downturn. The country's Buffett indicator, which measures the stock market value to GDP, has surged past its historical average of 0.83 to over 1.4, indicating that the market is overvalued. This has led to concerns about a potential bubble, with many analysts cautioning about the unrealistic climb of the Sensex above 85,000 points.

The impact of this market correction has been severe, with losses estimated at over ₹13 lakh crore in a single week. Key players such as Reliance Industries, HDFC Bank, L&T, Axis Bank, and ICICI Bank have borne significant losses, contributing to a 547-point drop in the Sensex. Foreign Institutional Investors (FIIs) have withdrawn approximately ₹32,000 crore from Dalal Street, further exacerbating the downturn.

The increasing appeal of China's market, coupled with global concerns over the Iran-Israel conflict, has caused investors to pull back from Indian equities. The possibility of a market crash during the festive season has further fueled uncertainty, despite continued confidence among retail investors. The market has experienced multiple sharp declines in the past four months, with heightened tensions in the Middle East and rising crude oil prices contributing to the negative outlook.

In the past four months, the Sensex has experienced multiple sharp declines. On June 4, the market shed 4,390 points following election results, resulting in a loss of ₹30 lakh crore for stock investors. The August 5 crash saw a decline of 2,223 points, leading to a market capitalization loss of ₹17 lakh crore. The trend continued on October 1 and 3, with losses of ₹3,000 crore and ₹9.5 lakh crore, respectively. By the end of the first week of October, the cumulative losses for four trading days reached an estimated ₹13 lakh crore, with the Sensex dipping by over 1,750 points and Nifty50 sliding to 25,250.

Heightened tensions in the Middle East have added to investor concerns, particularly after Iran launched missiles at Israel. The resulting uncertainty has driven down market sentiment. Additionally, rising crude oil prices and measures by the Securities and Exchange Board of India (SEBI) have contributed to the negative outlook. The resurgence of Chinese stocks has also led to significant fund outflows from Indian markets, further exacerbating the downturn.

Amidst elections in states like Haryana and Jammu & Kashmir, the market has reached a three-week low. While these elections may not have a direct connection to market performance, political uncertainties often make investors cautious, holding back on their investments. The surge in oil prices—from around $70 to $75 per barrel—and a 15-paise depreciation of the rupee have dealt a blow to market stability. This is seen as one of the worst shocks in two months, especially following the US Federal Reserve’s interest rate hikes.

The current sell-off has been driven primarily by a decline in banking, auto, and oil stocks, leading to a loss of ₹9.5 lakh crore in investor wealth. With the Dussehra festival around the corner, this downtrend could continue, causing further concern among investors.

Back in August, when the market faced a steep decline, Mahindra Group Chairman Anand Mahindra advised investors to stay calm, suggesting that India’s long-term growth potential remains strong. However, investor anxiety has been palpable, as seen through social media reactions and memes referencing Bollywood, reflecting their frustration. During this period, the Sensex fell below its Budget-day low, and Nifty50 dropped below its 20-day moving average, marking the largest single-day decline in over two months.

The continuous boom-bust cycle of the Indian market over the past two months highlights its vulnerability. Experts have pointed out that even though banks report rising credit levels, the reality is that average depositors have not been able to replenish these deposits adequately.

Market analysts emphasize that excessive enthusiasm—often driven by greed—has pushed Indian equities to unsustainable levels. Traditional indicators like price-to-earnings ratios signal that the market is overheated, suggesting that even a minor trigger could lead to a sharp correction.

The latest World Bank Business 2024 report also raises concerns about the principles of "ease of doing business" in India. It suggests that while businesses seek to maximize profits, there must be a balance that ensures consumer interests are protected. Public utilities, for instance, should maintain transparency by providing data that supports a healthy business environment.

Foreign Institutional Investors have a significant influence on the Indian market, capitalizing on both bullish and bearish trends. As they withdraw large amounts of capital, the market experiences heightened volatility. The profit-to-earnings (PE) ratio has reached its peak in Indian markets, a clear indicator of overvaluation. As FIIs sold shares worth ₹15,243 crore in a single day, market volatility surged, with India Vix closing at 13.17, marking the biggest jump in two months. A rising Vix signals greater uncertainty, while a decline suggests stability.

With rising global uncertainties and domestic inflationary pressures, India faces challenges in managing import costs and stabilizing prices. The upcoming Monetary Policy Committee meeting on October 7-9 may have to adopt a more cautious stance. It might have to go beyond a rate cut to stabilize the domestic market and maintain investor confidence.

The pressure on India’s stock market continues to build, raising concerns about a potential recession. While the market’s current state is worrisome, stakeholders are hoping that it does not escalate into a full-blown crisis, as India navigates these turbulent economic waters.

---------------