27

By Our Correspondent

New Delhi | Friday | 27 December 2024

The value of the rupee fell to more than eighty-five against the dollar. This is the biggest fall so far. It is being told that this has happened due to the change in the policies of the US Federal Reserve. After Corona, all the countries of the world were hit by recession. To recover from it, everyone took measures in their way. The US Federal has cut its interest rates to four and a half per cent. In this way, the position of the dollar has strengthened. Then, ever since Donald Trump won the presidential election, investors have started feeling that investing there is the most profitable. Therefore, many investors withdrew money from India and turned to America. Due to this, the foreign exchange reserves also started to deplete.

For some time, the fall in the value of the rupee against the dollar had almost stopped, and then experts began saying that the government had stopped the value of the rupee by withdrawing dollars from the foreign exchange reserves. But now that method is also probably not working. The fall in the value of the rupee against the dollar affects trade, tourism, education etc. India buys most of its fuel oil needs from other countries. In such a situation, the government's expenditure increases whenever the price of crude oil increases. Apart from this, we depend on other countries for raw materials for medicines, edible oil, electronic equipment etc. The burden on the pockets of students and tourists who go abroad to study increases. Therefore, the fall in the value of the rupee is a matter of concern.

This shift led many investors to withdraw funds from India in favor of the US, depleting India's foreign exchange reserves. The rupee's depreciation impacts various sectors, including trade, tourism, and education, increasing costs for fuel and imports of essential goods.

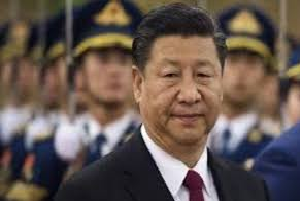

Despite efforts to boost exports and reduce the trade deficit, particularly with China, the situation remains challenging. High repo rates have not attracted sufficient foreign direct investment, and stagnant consumer income further exacerbates the issue. As the government aims for a $5 trillion economy, the declining rupee raises significant economic concerns.

There are some clear reasons for the fall in the value of the rupee. When the trade deficit increases, the value of the rupee against the dollar decreases. Although for years, emphasis has been laid on increasing exports, efforts are being made to promote the domestic market and Swadeshi, but the reality is that exports are continuously decreasing. To bridge the trade deficit, efforts were made to ban the import of many foreign goods and promote indigenous goods, this had some effect. But still, the trade deficit is not reducing. Especially our trade deficit with China is continuously increasing.

To control inflation, the Reserve Bank has continuously kept the repo rate high, but the situation is that the expected flow of capital is not happening in the market. The main reason for this is the lack of increase in people's income. These conditions affect foreign direct investment. As soon as foreign investors start feeling that consumer expenditure is decreasing in a country, they avoid investing there. For some time now, our growth rate and the condition of the manufacturing sector in it are not satisfactory. In such a situation, the inflow of dollars is reduced. In this situation, the value of the rupee starts falling. This trend is continuing in India. Naturally, concerns about the economy will increase. The government is determined to take the economy to five trillion dollars, but looking at the declining trend of the rupee, this confidence cannot be built.

******