29

Prof Shivaji Sarkar

New Delhi | Tuesday | 29 October 2024

The Indian stock market is currently grappling with severe challenges as signs of an economic slowdown emerge. With losses amounting to Rs 26 lakh crore for investors, coupled with a withdrawal of Rs 90,000 crore by foreign funds in October, the market saw its worst crash since the onset of the COVID-19 pandemic on October 25. This extended period of decline, amid uncertain global and domestic conditions, reflects a deeper malaise, suggesting that the economy is losing momentum.

On October 25, the Bombay Stock Exchange (BSE) Sensex recorded a drop of 662.87 points (0.83 percent), bringing it below the 80,000 mark to settle at 79,402.29. Likewise, the National Stock Exchange’s (NSE) Nifty saw a decrease of 218.6 points (0.9 percent), ending at 24,180.8. Throughout October, Sensex recorded a 5 percent fall, wiping out Rs 7 lakh crore in a single day and marking a significant downturn from its peak of 85,978.25 points on September 24. The Nifty also faced a sharp decline, closing near the critical level of 24,000, which, if breached, could exacerbate the bearish sentiment in the market.

One of the critical reasons behind this continued slide is the dismal performance of various companies in the second quarter (Q2) of 2024. According to stock analysis firm CLSA, these results have weighed heavily on investor sentiment, dampening the typically positive outlook of the festive season. Internationally, India’s stock market has emerged as the biggest loser in the past month, with the Sensex falling by 7.5 percent. Comparatively, other major global indices saw only minor declines: FTSE dropped by 0.25 percent, Nikkei by 2.41 percent, and Brazil’s Bovespa by 2.21 percent. However, markets like Shanghai and Hong Kong witnessed gains, further compounding concerns that foreign investors might be diverting funds from India to these regions.

Article at a Glance

India's stock market is facing significant challenges, with investors losing Rs 26 lakh crore and foreign funds withdrawing Rs 90,000 crore in October. The Bombay Stock Exchange (BSE) Sensex and National Stock Exchange's (NSE) Nifty have seen sharp declines, with the Sensex falling 5% in October. The main reasons behind this slide are poor company performances, global political tensions, and domestic uncertainties. The Indian economy is also showing signs of slowing down, with a drop in GDP growth rate, core industries' output, and car sales. Experts highlight five primary drivers of the market downturn, including the US presidential elections, geopolitical instability, and the depreciation of the Indian rupee. The government remains optimistic, but investors are cautious, and the market's struggles reflect the broader economic challenges India faces.

India’s economic trajectory, after several years of robust growth, appears to be losing steam. Data shows a drop in the GDP growth rate to 6.7 percent between April and June, down from 7.8 percent in the previous quarter. This slowdown is underscored by a decrease in the output of eight core industries, including coal, oil, and electricity, which fell in August for the first time in three years. Moreover, car sales, which serve as an indicator of consumer demand, dropped by 19 percent year-over-year in September, and collections from the Goods and Services Tax (GST) fell to their lowest levels in over three years. Together, these indicators signal a dip in economic activity.

Several factors have contributed to the recent market downturn, including global political tensions and domestic uncertainties. Experts highlight five primary drivers: the U.S. presidential elections, geopolitical instability, the Maharashtra state elections, weak Q2 corporate results, and the depreciation of the Indian rupee, which recently fell below Rs 84.07 per dollar. The rupee’s decline has made Indian assets less attractive to foreign investors, leading to record sell-offs by Foreign Portfolio Investors (FPIs), who withdrew a staggering Rs 85,790 crore in October. Despite efforts by Domestic Institutional Investors (DIIs), who invested Rs 97,090 crore to stabilize the market, stock indices have continued to plummet.

The dip in investor confidence is evident in the performance of small and mid-cap stocks, which have declined by over 8 percent in the past month. High valuations, combined with a shift of retail investors from the secondary market to initial public offerings (IPOs), have intensified the pressure. Additionally, small and mid-cap companies face challenges in expanding due to competition from large conglomerates and monopolies.

Other signs of economic strain include stagnating growth in factory output and weak manufacturing activity, which hit an eight-month low. Declining private investments, stagnant manufacturing, and falling real wages have also created headwinds for the economy. The situation could worsen if the conflict in the Middle East escalates, potentially driving up global oil prices. Economists estimate that a $10 increase in the price of a barrel of oil could reduce India’s GDP by as much as 0.4 percent, with the resulting increase in fuel subsidies likely to limit government spending in other areas.

While these challenges are significant, the government has taken a cautiously optimistic stance. The finance ministry acknowledged the recent economic strain as “incipient signs of stress” but suggested that these issues may be temporary. At its most recent meeting on October 9, the Reserve Bank of India (RBI) retained its GDP growth forecast of 7.2 percent for the current fiscal year. RBI Governor Shaktikanta Das reiterated his confidence in India’s economic fundamentals, asserting that the “growth story remains intact.”

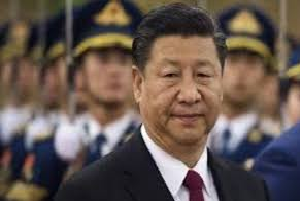

Yet, despite this optimism, there are fundamental concerns. The corporate sector is expected to see a growth rate of only 5-7 percent in the coming 16 months, with construction, industrial commodities, and investment all showing signs of stagnation. Revenue in the agricultural sector has dropped by 22 percent, further impacting the rural economy. Market observers suggest that some of the recent sell-offs are due to foreign investors moving funds from India to China, given the latter's recent stock market performance. Chinese markets have rebounded after a prolonged period of underperformance, and if this trend continues, more FPIs may redirect their capital to China, affecting India’s market liquidity.

The stock market’s struggles are emblematic of the broader economic challenges India currently faces. Although the government maintains that the country is on a growth trajectory, the convergence of global uncertainties, domestic economic slowdown, and policy pressures suggest that India’s economic landscape may remain volatile in the coming months. Investors will be closely watching for signals of stabilization, particularly from the RBI and the finance ministry, as they navigate these uncertain times.

As the world’s fifth-largest economy, India’s performance is critical, not just domestically but also globally. The market's recent turmoil emphasizes the importance of carefully balanced policies, effective economic management, and measures to restore investor confidence as the nation moves forward.

**************