27

Prof Shivaji Sarkar

New Delhi | Monday | 27 January 2025

The 2025-26 Union Budget presents a formidable challenge for Finance Minister Nirmala Sitharaman, as she navigates a complex array of economic pressures and policy dilemmas. Among her primary objectives are curbing inflation, spurring consumption, stimulating private investment, and ensuring India’s sustained development amidst signs of a slowing economy. These challenges are compounded by emerging domestic issues and international uncertainties, requiring a careful balancing act.

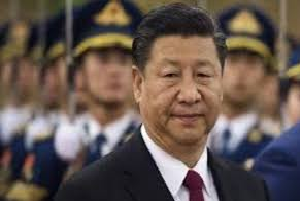

Globally, the policies of the newly-elected U.S. President Donald Trump are expected to add to India’s economic complexities. Higher crude oil prices and a stronger dollar, outcomes linked to his administration’s likely energy and trade policies, could create additional inflationary pressures and increase the burden of imports on the Indian economy. Domestically, the urban consumption engine, which has traditionally been a reliable growth driver, has weakened. Similarly, private investment remains subdued, contributing to a noticeable slowdown in economic activity. India’s GDP growth rate has dipped to a two-year low of 5.4 percent, with annual growth estimates for 2024-25 forecast at 6.4 percent—a stark decline from the impressive 8.2 percent achieved in 2023-24.

Despite these challenges, the Reserve Bank of India (RBI) remains optimistic, maintaining that the country’s structural growth drivers are intact. However, there is no ignoring the pressing issues facing the rural economy and the agriculture sector, both of which demand urgent intervention.

Indian agriculture is at a crossroads, grappling with a host of challenges, including a growing population, shrinking land resources, climate change, and increasing nutritional demands. Labor shortages, inadequate mechanization, pricing dilemmas, and environmental concerns further complicate the situation. The government plans to increase agricultural spending by 15 percent to $20 billion in the 2025-26 budget. This allocation aims to enhance rural incomes and control inflation by focusing on high-yield crop development, improving storage and supply chain infrastructure, and promoting the production of pulses, oilseeds, vegetables, and dairy.

However, these initiatives face a time lag before yielding tangible results. Agriculture remains the backbone of the Indian economy, employing over 54 percent of the workforce but contributing only 18 percent to India’s Gross Value Added (GVA). Increasing productivity in this sector is critical, yet challenging. According to an International Monetary Fund (IMF) report, India’s agricultural labor productivity (PPP adjusted) is just 12.2 percent of the median productivity in advanced economies and 43 percent of that in other emerging markets.

Rural and agricultural reforms are therefore essential to ensure inclusive growth. Expanding funding for allied activities like agroforestry, animal husbandry, and fisheries can provide small and marginal farmers with additional income streams. Investments in cattle farming, poultry, sheep rearing, and fisheries, including shrimp farming, have the potential to significantly boost rural incomes. Similarly, promoting natural and organic farming through certification, branding, and bio-inputs via dedicated resource centers can help align agricultural practices with sustainability goals. Initiatives like increased budgetary support for organic fertilizer production, utilizing resources like cow dung, also have the dual advantage of fostering self-reliance and reducing dependency on imported chemical fertilizers.

Nonetheless, reducing the use of chemical fertilizers such as urea, DAP, and other nitrogen-phosphate-potash-based products remains a formidable challenge. Despite global price increases, the Indian government continues to subsidize fertilizers, with the subsidy for DAP set at ₹3,850 per ton. Maintaining affordability for farmers while managing the fiscal burden is a delicate balancing act.

Additionally, the NSSO Household Consumption Expenditure survey highlights the rural-urban divide, with rural Monthly Per Capita Consumption Expenditure (MPCE) averaging just 58 percent of urban MPCE. While various schemes have aimed to increase rural incomes in recent years, progress has been gradual. Over the past five years, only 3 percent of the total budgeted expenditure has been allocated to the Ministries of Agriculture, Fisheries, Animal Husbandry, and Dairying, signaling the need for stronger support.

Infrastructure investments, such as road projects, have undoubtedly benefited corporations but have also resulted in unintended consequences, such as the loss of 50 lakh hectares of arable land. Rising tolls and higher input costs have further compounded the difficulties faced by Indian farmers. These issues underscore the need for more holistic infrastructure planning that balances development with agricultural needs.

Beyond agriculture, the government faces additional challenges. The global economy’s uncertainties, coupled with the resurgence of “Trumpism,” could put immense pressure on international markets, leading to rising petrol prices and disruptions in alternative energy policies. Indian exports and employment opportunities are also at risk. Meanwhile, advancements in IT and artificial intelligence are creating challenges for Indian enterprises, potentially leading to job displacement.

Manufacturing and other industrial sectors are similarly constrained by low purchasing power among individuals. To address this, the Finance Minister must explore policies to reduce manufacturing costs, thereby controlling inflation. A reexamination of the Goods and Services Tax (GST) framework may also be necessary, although such reforms may remain a distant hope.

Taxation reforms are another pressing issue. While the government has reduced corporate tax rates to 22 percent, public demand for similar relief in income tax remains high. Yet, given the fiscal constraints, the Finance Minister may find it difficult to introduce substantial tax cuts. Rising costs in transportation, including railway fares, also need attention, but finding solutions without overburdening the exchequer poses a significant challenge.

Ultimately, while agriculture remains the backbone of the economy, the budget must strike a balance between its needs and those of other sectors. India requires a long-term economic vision that goes beyond simply achieving trillions in economic milestones. The nation must focus on becoming a low-cost, fast-growing economy capable of ensuring equitable and sustainable development. Bold reforms, innovative policies, and a focus on inclusive growth are essential for India to overcome its economic challenges and achieve its aspirations.

**************