26

The RBI has given a record Rs 2.69 trillion dividend to the government against Rs 2.1 trillion last year, reportedly fuelled by dollar sales and forex gains and growth in interest income amid the International Monetary Fund (IMF) projections that India will surpass Japan to become the world's fourth-largest economy in 2025.

The RBI bonanza surpasses the union budget 2025 projections Rs 2.56 lakh crore dividend earnings from PSUs. It will help the government cut fiscal deficit and borrowings. It is the highest dividend paid since 2011-12, when it was a mere Rs 15009 crore and 2013-14 it rose Rs 33010 crore. Even during the demonetisation in 2016-17, it was Rs 65876 crore and Rs 176,051 in 2018-19. It tapered to Rs 40000 crore in 2018-19 to rise again to Rs 99,122 crore in 2020-21.

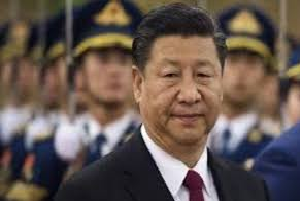

India has taken another major leap on the world stage, becoming the fourth-largest economy as its nominal GDP reaches $4.187 trillion—edging past Japan’s $4.186 trillion.

According to the IMF’s World Economic Outlook, India emerging as a dominant growth engine, to grow at 6.3 percent this year — below the earlier 6.5 percent estimate. In contrast, Japan’s growth outlook has been sharply downgraded to just 0.6 percent, down from 1.1 percent in January, weighed down by trade tensions and demographic headwinds.

A significant per capita income gap exists between the two countries, with 12 times difference. Indian growth trajectory may potentially overtake Germany by 2027 becoming the third-largest economy.

There is a caveat in the dividend story. The RBI simultaneously announced drop in $ 4.9 billion dip in forex reserves to $ 685.7 billion from a record $ 704 billion in September 2024. Since the peak reserves, the RBI sold a significant amount of dollars to ensure currency stability, the report said.

The exceptional surplus dividend transfer is largely a result of the RBI’s aggressive intervention in the foreign exchange market. In fact, in January 2025, the RBI emerged as the largest seller of foreign exchange reserves among all Asian countries.

With this transfer alone, actual receipts will far exceed the budgeted target—providing welcome fiscal headroom ahead of the general elections.

This decline in reserves was primarily driven by a drop in gold reserves, offsetting a slight increase in foreign currency assets. The RBI's interventions in the forex market to manage rupee volatility likely contributed to this fluctuation. It amounts to about Rs 1.7 billion. Actually, the RBI gains are for buying gold at lower rates months ago. The gold has appreciated sharply since January.

Gold prices have been on a global rally, with estimated 39.75 percent return in 2024-25, the highest in four decades. A declining dollar makes gold cheaper for non-US buyers, increasing demand and pushing prices up. Central banks purchases increase gold prices. Gold could continue to rise, potentially reaching new record highs, with Goldman Sachs forecasting a price of $3,700 per ounce by the end of 2025. Gold's role as a safe-haven asset during times of uncertainty has also fuelled demand, particularly with rising geopolitical tensions and trade war fears.

According to RBI's data, during the past one year, the country's special drawing rights (SDRs) fell by $ 43 million to $18.490. Meanwhile, India's reserves position in the IMF declined by $ 3 million to $ 4.371 billion

These assets are affected by the value changes of currencies like the euro, pound, and yen compared to the US dollar. Gold reserves saw a significant drop of $ 5.121 billion to $ 81.217 billion after a sharp rise of $ 4.52 billion the week before. This indicates the severe volatility as also a pointer to the sudden reasons of gold reserve dwindling.

The rupee has, meanwhile, gained by 79 paise from its previous close of Rs 86. The gain in rupee came as the dollar weakened to its lowest level since 2023 after US President Donald Trump proposed 50 percent tariff on European Union imports from June 1 and a 25 percent tariff on Apple Iphones manufactured outside the US.

The dividend bonanza may have been possible as India has broader global economic shift. With favourable fundamentals and resilience amid global uncertainty, India is now reshaping the balance of economic power in Asia and beyond. By 2030, the IMF estimates India’s economy will grow to $6.8 trillion—20 percent larger than Germany’s and over one-third bigger than Japan’s.

In such situation the RBI turning the tide adds to the hopes. Everything in the forex market may not be as rosy as is being painted. The stock market despite some gain on the weekend by 979 points has lost heavily all through between May 19 and 25 by 2587 points for a combination of domestic issues and turmoil in the international market.

Between April 2024 and February 2025, gross dollar sales reached an unprecedented $ 371.6 billion—more than double the $ 153 billion sold in FY24. These large-scale interventions not only helped contain rupee volatility but also generated substantial forex trading gains, boosting the RBI’s surplus.

The central bank also earned more from its rupee-denominated securities. Its holdings in these securities rose by Rs1.95 lakh crore, to Rs 15.6 lakh crore by March 2025. While the fall in government bond (G-sec) yields reduced mark-to-market gains, overall interest income continued to rise steadily.

The Contingent Risk Buffer (CRB), which acts as a safeguard against future risks, was maintained within a range of 7.5 per cent to 4.5 per cent of the RBI's balance sheet, as recommended by the central board.

The transferable surplus was calculated under the revised Economic Capital Framework (ECF), approved by the RBI's Central Board during its meeting on May 15, 2025.

The SBI report also underscores the RBI’s cautious approach to financial risk. Though the final dividend payout is ₹2.7 trillion, The SBI estimates it could have exceeded Rs 3.5 trillion if the central bank hadn’t increased its Contingent Risk Buffer (CRB). The CRB, which serves as a safeguard against future economic shocks, was maintained within the recommended range of 5.5 percent to 6.5 percent of the RBI’s balance sheet, as advised by the central board. The report further highlighted the RBI's prudent approach in maintaining financial stability. While the dividend payout stands at Rs 2.7 trillion, it could have exceeded Rs 3.5 trillion if not for the RBI's decision to increase its risk buffer.

**************