8

Today’s Edition

New Delhi, 8 January 2024

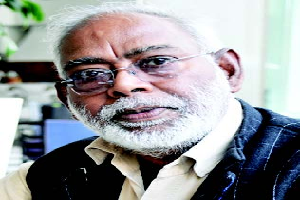

Shivaji Sarkar

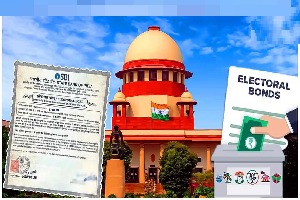

The Supreme Court decision denying a special investigation team (SIT) probe on Hindenburg report on Adani has not come as a surprise. The SEBI stand helped the process.

On January 3, the Securities and Exchange Board of India (SEBI) leveraged the Supreme Court verdict to its advantage. On January 5, it addressed the primary concern raised by the Hindenburg report regarding short-selling, deeming it a non-issue. The legal acceptance of short-selling shares, that caused parliamentary logjams, means it is now permissible for everyone.

More interestingly only a month back on December 5, 2023, the US government said, “short-seller Hindenburg Research’s allegations of corporate fraud against billionaire and Adani Group Chairman Gautam Adani weren’t relevant and did not impact the US decision to grant $ 553 million for a Sri Lankan port terminal”. The US would not invest if it was not sure of its investments being safe. In fact, the US has never given importance to the Hindenburg report.

Shortly after the report came out on January 30, 2023 Adani Group damning allegations, terming it “nothing but a lie” said that it was a “calculated attack” on India. After the SC verdict, the group says the report was driven by “an ulterior motive” to “create a false market to allow the US firm to make financial gains”.

The similarity of the approach of the US government, Adani group, silence or nor surprise of the official system in India and all saying the Hindenburg researcher at fault may not be coincidental. Except vague charges, nothing concrete has been told about the researcher.

The SC has not differed from its observation of May 20, 2023, when SC appointed panel said, “Prima facie no manipulation by Adani group”.

Hindenburg released a comprehensive report accusing Adani Group of lang-standing malpractices ranging from stock valuations to offshore shell entities. The expose came just before the Adani Group was to launch $ 100 billion stocks.

Gravity of the allegations spurred various regulatory bodies to take notice of it. The SC acknowledged the seriousness and initiated an investigation. The stock market watchdog Securities and Exchange Board of India (SEBI) started its probe into market manipulation and fraudulent activities. The opposition parties seized the opportunity to raise questions and demand answers leading to many logjams and sharp barbs in both the houses of Parliament. Citing the magnitude of the allegations, the opposition called for a thorough investigation to ensure accountability.

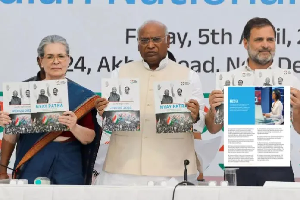

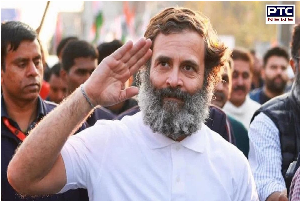

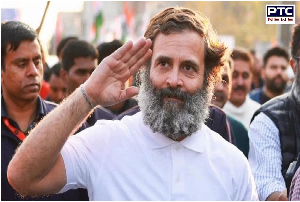

It led to suspension of Congress leader Rahul Gandhi and later Trinamool firebrand leader Mohua Moitra. On these and host of other issues, even the December winter session witnessed uproarious scenes resulting in unprecedented suspension of 146 MPs.

It remains a raging political issue despite the SC ruling. It can be a volatile 2024 election issue.

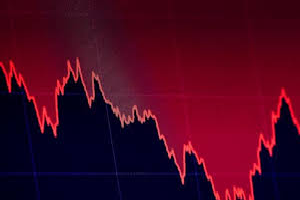

The Hindenburg Report had shaken the Adani stocks. The report said that its two-year investigations reveal that “Rs 17.8 trillion ($ 218 billion) conglomerate engaged in a brazen stock manipulation and accounting frauds over the decades”. It disclosed that it held short positions in Adani company through US-traded bonds and non-Indian-traded derivatives. It alleged Adani improperly using tax havens and also expressed concerns about its high debt levels.

It sparked a $ 150 billion meltdown in shares of Adani’s publicly listed companies last year. The shares are still reported to be do,wn by about $47 billion.

Within a week of the 32000-word report, the Bombay Stock Exchange had deep scars. Investors lost Rs11.8 lakh crore at BSE and Nifty. Bank stocks suffered the worst collateral damage. Ripples continued through the year though now Adani Group claims it made up the losses.

The Adanis released a 413-page response to clarify its position and lambasted Hindenburg for using the company reports itself to malign it through short selling “to book massive financial gain through wrongful means at the countless investors”.

Hindenburg retorted short-selling was a part of its research methodology to unravel the manipulations. A short-sell is defined as a trading strategy where an investor borrows shares of a stock they believe will decrease in value, sells them, and then hopes to repurchase the shares at a lower price to make a profit. It is not illegal either in the US or in India.

In May, a Supreme Court-appointed committee in an interim report said it saw, “no evident pattern of manipulation” in Adani companies and there was “non regulatory failure”. Simultaneously, it cited many amendments the SEBI made between 2014 and 2019. These constrained the SEBI’s ability to investigate. The panel also said that its probe into alleged violation of money flows from offshore entities had “drawn a blank”. Regulators are known to modify rules to widen their ambit. Just the contrary happens here.

Newspapers were agog with many stories. The SC while rejecting the demand for SIT to go into the allegations also maintained that the reliance on newspaper articles or reports by third party organisations as the basis for questioning investigation by a specialised regulator does not make sense. It also rejected reports by the Financial Times and OCCRP (a network of journalists) in August.

It reminds the 1950 SC rulings on the freedom of the Press and expression. That implied that newspapers are not frivolous publication and editors were supreme in editorial decisions.

Independent petitioners questioned the amendments by SEBI on foreign portfolio investors (FPI), diluting the requirements of disclosure of beneficial owners. The court on the contrary held that the amendments tightened the regulatory framework. On the 2014 probe by Directorate of Revenue Intelligence (DRI) into stock manipulation by Adani group, through overvaluation of power equipment purchased from a UAE subsidiary, the SC noted the issue had already been settled in favour of the Adani group.

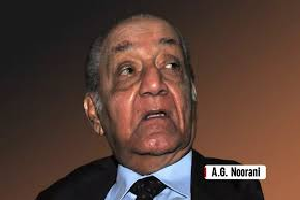

Senior lawyer Mahesh Jethmalani alleged that a group was filing cases with political motive at the behest of foreign forces.

No judicious system could function with such premise. Judgments apart there could be different interpretations. It may be reprieve to a company but socially and financially stock manipulations are grave and sensitive. It raises questions on issues of ethics, morality and security of the investors.

Stock manipulations are not new. It brazenly came to the fore in 1992 and there have been many shady activities during the last 30 years. The present incident exhibits proliferation of sophisticated operations shaking confidence in opaque manoeuvrings.

----------