3

Prof Shivaji Sarkar

New Delhi | Friday | 2 May 2025

The US tariff war, which has reset the world order for 80 years, will slow global growth to 2.8 per cent in 2025, down from the January forecast of 3.3 per cent, according to the World Economic Outlook (WEO) of the International Monetary Fund (IMF).

The IMF seemingly has a grim forecast as it foresees the repetition of the Great Depression (GD) or worse, as the US effective tariff rate surged past levels reached during the GD, while counter-responses from major trading partners significantly pushed up the global rate. The world may be in turmoil as the US may plunge into a severe slowdown with its growth plunging to 1.8 per cent, a 90-basis-point loss. The problems could surpass the economic trouble to worsening trade tensions, a hint towards a bigger political conflict.

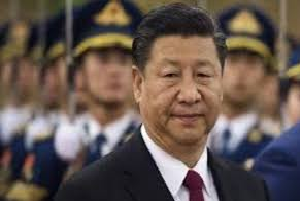

The silver line - India is to grow at 6.2 per cent, almost in sync with Reserve Bank of India projections, though China is likely to lose steam as its GDP growth is downgraded to 4 per cent, down from 4.6 per cent in the January 2025 WEO forecast. For India, however, the growth outlook is relatively more stable. The IMF projects steady expansion for the Indian economy, supported by firm private consumption, particularly in rural areas. In a global environment marked by uncertainty and subdued growth, India’s resilience stands out, reinforcing its role as a key driver of global economic activity.

Despite these revisions, India’s robust growth trajectory continues to set it apart on the global stage. The projections could change the global investment pattern. It might create an additional interest for India despite the capital flight witnessed in the country’s bourses, falling rupee against the dollar and surging gold and silver prices. The rupee could fall further as the WEO says the US benefits as a tariffing country in the dollar appreciating further. Apart global investment scenario could face difficulties, adding to the problems in the Indian market.

The IMF warns of potential economic turmoil reminiscent of the Great Depression, as rising tariffs negatively impact productivity and increase prices. In contrast, India is expected to grow at a robust 6.2%, supported by strong private consumption, while China's growth is downgraded to 4%.

The IMF highlights increased risks to the global economy, including tighter financial conditions and potential volatility in emerging markets. Despite these challenges, India’s resilience positions it as a key driver of global economic activity, although it must navigate significant external pressures and uncertainties.

However, greater policy uncertainty, dimmer US growth prospects, and an adjustment in the global demand for dollar assets—that has so far been orderly—can weigh down on the dollar. In the medium term, the dollar may depreciate if the tariffs translate into lower productivity in the US tradable goods sector, relative to its trading partners.

Risks to the global economy have increased, and worsening trade tensions could further depress growth. Financial conditions could tighten further as markets react negatively to the diminished growth prospects and increased uncertainty. While banks remain well-capitalised overall, financial markets may face more severe tests.

Tariffs constitute a negative supply shock leading to productivity loss accompanied by higher production prices, increased rent seeking – a word for rising corruption, that could further impact world growth. Monopolisation could increase as competition decreases.

In the US, demand was already softening before the recent policy announcements, reflecting greater policy uncertainty. With a one percentage point rise in inflation above 2 per cent predicted earlier, it could spur global prices to rise.

Growth in the Euro area, which is subject to relatively lower effective tariffs, is revised down by 0.2 percentage point, to 0.8 per cent. Both in the Euro area and China, stronger fiscal stimulus will provide some support this year and next. Many emerging market economies could face significant slowdowns depending on where tariffs settle. The WEO lowers its growth forecast for the group by 0.5 percentage point, to 3.7 per cent.

Uncertainty Rises, Oil Softens

Dense global supply chains, WEO says, can magnify the effects of tariffs and uncertainty. Most traded goods are intermediate inputs that cross borders multiple times before being turned into final products. Disruptions can propagate up and down the global input-output network with potentially large multiplier effects, as we saw during the pandemic. Companies facing uncertain market access will likely pause in the near term, reduce investment and cut spending. Likewise, financial institutions will reassess borrowers’ exposure. The increased uncertainty and tightening of financial conditions could well dominate the short term, weighing on economic activity, as reflected in the sharp decline in oil prices.

Risks to the global economy have increased, and worsening trade tensions could further depress growth. Financial conditions could tighten further as markets react negatively to the diminished growth prospects and increased uncertainty. While banks remain well-capitalised overall, financial markets may face more severe tests.

“Growth prospects could, however, immediately improve if countries ease their current trade policy stance and forge new trade agreements”. Addressing domestic imbalances can, over the years, offset economic risks and raise global output while contributing significantly to closing external imbalances. For Europe, this means spending more on infrastructure to accelerate productivity growth, a prescription that increases cut-money syndrome. It also means boosting support for domestic demand in China, and stepping up fiscal consolidation in the US”, says WEA. The scenarios are painted with many conditions. In short, the IMF does not appear optimistic.

Assessing the global financial stability, it says that risks have increased significantly as financial conditions tightened and economic and trade policy uncertainty remain elevated. There are three key vulnerabilities. High valuations in some major segments indicate further deterioration and tightening. It would impact emerging markets’ currencies, asset prices, and capital flows.

Second, some financial institutions could come under strain in volatile markets like the banking and non-banking NBFCS. Third, further turbulence could descend upon sovereign bond markets, especially in jurisdictions where government debt levels are high. More challenged market functioning and the unwinding of popular leveraged trades in core sovereign bond markets could contribute to further volatility. Emerging market economies already facing the highest real financing costs in a decade may now need to refinance their debt and fund fiscal spending at higher costs.

Overall, investor concerns about public debt sustainability and other fragilities in the financial sector can worsen in a mutually reinforcing fashion.

As the IMF reaffirms India’s economic resilience, the country’s role as a key driver of global growth continues to gain prominence. It feels the country can sustain momentum in a complex international environment. Despite that, the threat is not diminished. It is witnessed in its volatile bullion, currency market, inflation indicators and manufacturing. India has chances to stand apart, but weathering the global winds would not be easy.

**************