9

In a decisive shift to shield the Indian economy from both internal slowdowns and global turbulence, the Reserve Bank of India (RBI) has cut the repo rate by 50 basis points to 5.40% and slashed the Cash Reserve Ratio (CRR) by 100 basis points, injecting a massive ₹2.5 lakh crore into systemic liquidity.

This is no routine monetary easing. It’s a strategic pivot aimed at buffering the economy from external shocks—particularly rising protectionism and trade disruption—as well as bolstering domestic demand that still lags pre-pandemic levels.

Global Headwinds, Local Strategy

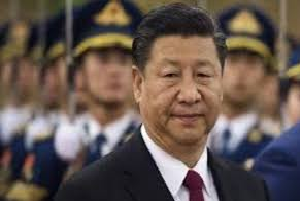

The RBI’s move comes against a backdrop of global uncertainty. The resurgence of former U.S. President Donald Trump has stirred fears of renewed tariff wars, decoupling of global trade, and a dollar surge—all of which previously hammered emerging markets like India. Global trade volatility and weakened capital flows further justify the central bank’s proactive stance.

While inflation has stayed within RBI’s comfort range, the specter of imported inflation—driven by rising global crude oil prices, shipping costs, and geopolitical tensions—has grown louder. The central bank has clearly weighed these risks, but is now prioritizing growth over caution, betting that boosting economic momentum is the more urgent imperative.

Market Reaction: Relief and Revival

Financial markets welcomed the RBI’s policy announcement with optimism. Interest rate-sensitive sectors such as real estate, banking, automobiles, and financial services rallied, recouping losses after months of stock market volatility and erosion of investor confidence.

Currency in circulation has risen sharply—from ₹16.5 lakh crore in November 2016 to ₹38.35 lakh crore by May 30, 2025, an annual growth of 7.4%. Reserve money—comprising physical currency, commercial banks’ deposits with the RBI, and CRR balances—also rose 0.4% weekly to ₹49.62 lakh crore.

As the foundational layer of India’s monetary system, reserve money is crucial for credit expansion. By slashing CRR, the RBI effectively unleashes a fresh wave of lending power into the economy, supporting broader money supply and economic activity.

The Trump Trade Effect and Imported Pain

India remains highly susceptible to trade disruptions. With imported inflation jumping from 1.3% in June 2024 to 31% now, and heavy reliance on imported crude, chemicals, and machinery, the nation is vulnerable to global price surges or supply chain bottlenecks.

Trump’s return to the U.S. political spotlight has rekindled fears of an “America First” doctrine—raising the risk of tariffs, tighter U.S. monetary policy, and increased volatility in global capital flows. India is already rushing through shale oil and commodity import deals, potentially raising future import bills.

The RBI’s aggressive policy response signals that India won't wait for external stability—it will build internal cushions now.

Sectoral Impact: Real Estate, Auto, and Lending

The real estate sector, beset by rising input costs from steel and cement, stands to benefit from lower borrowing costs and improved liquidity. Major realty stocks like DLF, Godrej Properties, and Kolte-Patil surged following the RBI’s announcement, buoyed by expectations of renewed housing demand and easier financing.

Affordable housing, in particular, is likely to get a boost, insulating the sector from foreign investment uncertainty and material cost spikes.

The auto sector also benefits. Plagued by global supply chain hiccups and costlier imports, the industry can now leverage cheaper financing to counter price-sensitive demand issues. Auto loans are expected to see stronger uptake, offsetting costs from potential trade-driven import duties.

However, the government’s rule mandating the scrapping of 10-year-old vehicles adds to the sector’s challenges. This policy, while environmentally driven, imposes additional costs on transport operators and could slow down logistics-linked industrial activity.

Latest data reflects this strain: India’s core sector—comprising eight key industries—grew just 0.5% in April 2025, while the Index of Industrial Production (IIP) is expected to expand by a modest 1-2%, pointing to weak industrial momentum.

Banking on Domestic Credit

With ₹2.5 lakh crore of liquidity unleashed, banks and non-banking finance companies (NBFCs) are better equipped to grow their loan books—even if foreign capital inflows falter. Financial stocks like HDFC Bank and Bajaj Finserv rose sharply on renewed confidence in the domestic credit cycle.

The Nifty Financial Services index climbed nearly 2%, underscoring belief that India's financial system is becoming less reliant on volatile foreign portfolio flows and more driven by internal lending—a crucial safeguard in case global liquidity tightens again.

The Inflation Challenge Ahead

Imported inflation—caused when a weaker rupee or global price spikes make imports costlier—is a looming risk. India’s heavy dependence on imported crude oil and gold, along with electronic goods and industrial machinery, leaves it exposed.

While domestic inflation remains manageable, the potential for a tariff-heavy U.S. trade policy could push global prices higher. The RBI’s policy action appears pre-emptive—seeking to stimulate economic growth before inflationary pressures escalate further.

Higher production costs are already making their way through supply chains. If companies pass these costs on to consumers, India could see inflation rise sharply in the months ahead, making the current liquidity push even more critical.

RBI’s New Playbook: Resilience Over Reaction

This policy shift marks a significant evolution in the RBI’s approach. No longer just focused on inflation targeting in isolation, it now signals a broader objective: defend India’s economic growth in a volatile, often adversarial global environment.

In many ways, the RBI is adopting the logic of protectionist economies—acting boldly to protect domestic interests before external shocks take hold. The message is clear: if globalization retreats, India must be prepared to rely on its own engines of growth.

Conclusion: Building at Home, Watching the World

The RBI’s sweeping rate cuts and liquidity infusion represent more than just a response to slowing data—they’re a bold attempt to insulate India from a world heading toward deglobalization 2.0.

As U.S. politics turn more inward and global trade realigns, India is signaling it won’t wait. It will stimulate domestic demand, support investment, and prepare for economic self-reliance—ready to weather foreign tantrums and global storms alike.

In uncertain times, India’s growth story may well depend on what it does within its own borders. The RBI has made the first move.

**************