25

Prof Shivaji Sarkar

New Delhi | Monday | 25 November 2024

The unfolding Adani episode underscores the urgent need to balance corporate ambition with public accountability. A failure to act decisively risks further eroding India’s global economic reputation and investor confidence. Ensuring ethical corporate governance, maintaining transparency, and aligning business practices with international standards are crucial to restoring trust. Members of Parliament must also prioritise corporate accountability to sustain economic growth.

Corporate bodies such as the Federation of Indian Chambers of Commerce and Industry (FICCI), the Associated Chambers of Commerce and Industry of India (ASSOCHAM), and the PHD Chamber of Commerce and Industry should push for legislative reforms, including the revival of Monopolies and Restrictive Trade Practices (MRTP)-type laws. Such measures could reintroduce safeguards against monopolistic practices and ensure that incidents like the Satyam accounting scandal are not repeated.

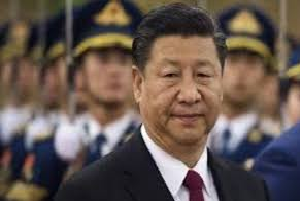

Gautam Adani is not just another Indian billionaire. Over the past decade, his conglomerate, the Adani Group, has evolved into an extension of India’s government. The group’s activities span ports, factories, and power plants, often involving state contracts or licenses. This close relationship has positioned the Adani Group as a central figure in India’s economic landscape, particularly since Prime Minister Narendra Modi’s rise to power in 2014.

However, recent allegations have cast a shadow over Adani's meteoric rise. On November 21, U.S. federal prosecutors charged the Adani Group with multiple counts of fraud. The charges include offering $265 million in bribes to Indian officials and misleading Wall Street investors about the scheme while raising funds for a renewable energy project. These accusations, while criminal offences under U.S. law, have broader implications for India’s trade and investment relations, especially in emerging markets like Africa and Southeast Asia.

Despite Adani Group’s assertions of innocence under Indian law, the fallout has been significant. The group has vehemently denied allegations of market manipulation and fraud, submitting affidavits to the courts and regulatory agencies such as the Securities and Exchange Board of India (SEBI). Nevertheless, investor confidence has been shaken. The SEBI chairperson, Madhavi Buch, faced scrutiny due to her husband's controversial investments in Adani-related entities, adding to the perception of a compromised regulatory framework.

The market response has been severe. Following the latest U.S. indictment news, the combined market capitalization of the 11 Adani Group companies dropped by ₹38,000 crore. Rating agency S&P Global downgraded its outlook on three group entities to "negative." Additionally, international partners are re-evaluating their associations. For instance, Kenya cancelled a $2.6 billion deal with the Adani Group, citing unrealistic terms—a scenario reminiscent of similar issues in Bangladesh. Even Adani’s investments in Sri Lanka are under scrutiny.

The broader impact on Indian corporates is profound. The credibility of Indian companies is at stake, affecting their ability to raise funds internationally. This situation mirrors the fallout from the 2009 Satyam scandal, where accounting fraud involving an international auditing firm severely tarnished India’s corporate reputation.

The roots of India’s current corporate governance challenges can be traced back to policy shifts in the 1990s. The MRTP Act, enacted under Prime Minister Indira Gandhi in 1969 to curb monopolistic practices, was gradually diluted during the economic liberalization era. In 1991, the PV Narasimha Rao government removed pre-entry restrictions on mergers and acquisitions, setting the stage for a more corporate-friendly environment. By 2009, the UPA-I government under Manmohan Singh formally scrapped the MRTP Act, replacing it with the Competition Act.

While these changes were aimed at fostering economic growth, they inadvertently weakened safeguards against corporate misgovernance. The absence of robust checks and balances has allowed some companies to operate with little accountability, leading to situations like the Adani episode.

The parallels between the Adani controversy and the Satyam scandal highlight the need for stronger regulatory oversight. The 2009 Satyam scam, involving founder Ramalinga Raju’s manipulation of company accounts, exposed significant gaps in corporate governance. Despite reforms introduced in its aftermath, the recurrence of high-profile scandals suggests that existing measures are insufficient.

Reviving MRTP-type legislation could serve as a critical step in addressing these issues. Such laws would not only prevent the concentration of economic power but also ensure ethical corporate behaviour. Additionally, Parliament must play a more active role in holding corporations accountable. While past Parliament sessions have witnessed vigorous debates on corporate misconduct, the current silence on such matters is concerning. For instance, only one MP recently raised the issue of corporate gifts influencing parliamentary committees.

India must strike a balance between promoting corporate growth and ensuring accountability. The return of MRTP-type safeguards should be a priority to rebuild trust in the corporate sector. Such reforms would align India with global best practices, enhancing its attractiveness to foreign investors. Furthermore, Parliament must reclaim its role as a watchdog, ensuring that corporate entities contribute to economic growth without compromising ethical standards.

The erosion of credibility witnessed in the Adani episode serves as a stark reminder of the cost of neglecting corporate governance. India’s lawmakers have a responsibility to act decisively, not to stifle corporate ambition, but to ensure that businesses operate transparently and contribute to the nation’s long-term growth. The country cannot afford to ignore these lessons if it wishes to maintain its position as a global economic powerhouse.

--------------------